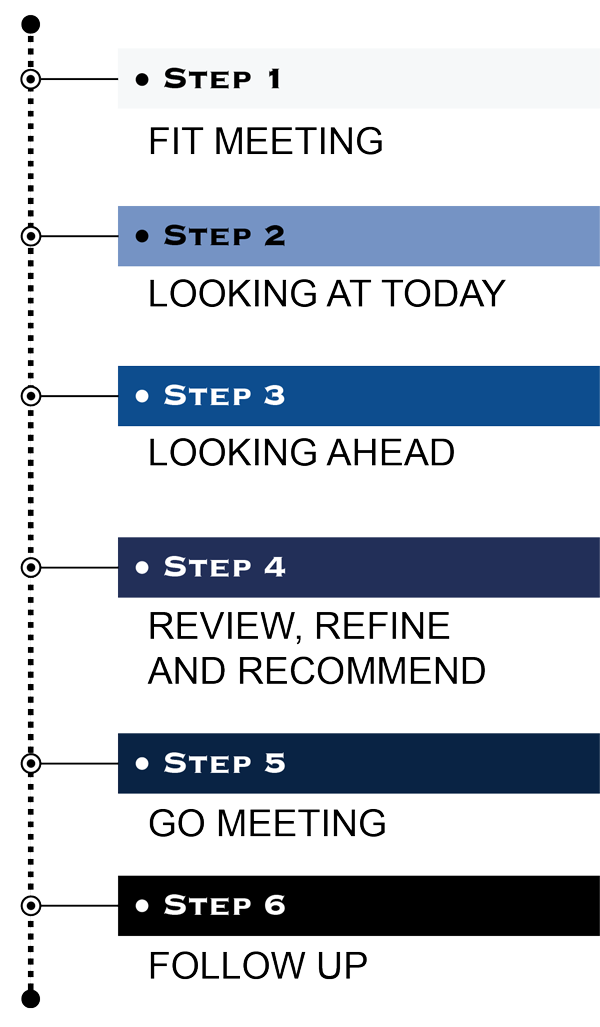

Our Process

The Client Welcome Experience

The basis for successful investing lies in understanding client goals, objectives, risk tolerance levels, and return expectations. The best method of determining what those goals are is the investment planning process. The following process is designed to define and meet specific client goals.

FIT MEETING

- Discuss your current financial landscape

- Identify your unique goals, values, dreams, special concerns and challenges

- Do we get along?

LOOKING AT TODAY

- Discuss financial data from checklist

- Focused goal achievement discussion

- Complete client social profile

- Begin Goal-Based Planning

LOOKING AHEAD

- In-person meeting to review comprehensive wealth management solutions and strategies including tax control, income generation and additional resources

- Finalize Goal-Based Planning

- Discuss strategies and portfolio alignment

REVIEW, REFINE AND RECOMMEND

- Analyze current investment portfolio and refine strategies

- Review recommendations around income, stability of principal and growth basis, reconciliation and transfer costs

- Develop strategies based on recommendations and goal-focused plans

GO MEETING

- Open new accounts

- Transfer existing assets

- Introduce support team

- Assist with retirement plan paperwork

FOLLOW UP

- In-person meeting

- Discuss statements

- Organize documents

- Review online capabilities and set up online account access

- Customize a schedule for ongoing calls, meetings and check-ins